Optimism among marketers plummets to levels last witnessed during the Great Recession. Optimism about the economy is 50.9 (out of 100) compared to just three months ago when it was 62.7. In February 2009, following the Great Recession of 2008, this rating was 47.7. B2C companies are more pessimistic than their B2B counterparts, as are larger revenue companies (>$10B) compared to their smaller counterparts (<$25M).

Against this backdrop, The CMO Survey conducted a Special Covid-19 Edition survey, asking marketing leaders at U.S. for-profit companies to share their survival strategies, KPIs, and predictions about the future. Here are the top results.

- Marketing jobs lost: Although 62% of marketing leaders reported no job losses in their companies, 9% of marketing jobs have been lost, on average, due the pandemic. The largest percentage of marketers (24%) anticipate these jobs will never return. Planned marketing hiring drops to the lowest point in CMO Survey history, going negative for the first time ever with average hiring predicted to be -3.5% in the next year.

- Customer prioritize digital experiences: Marketers report increased openness among customers to new digital offerings introduced during the pandemic (85%), increased value placed on digital experiences (84%), and greater acknowledgements of companies’ attempts to “do good” (79%). Marketers expect this increased focus on digital to be a permanent shift in consumer behavior.

- Marketers pivot digital: Given customer shifts, marketers are, in turn, adjusting their offerings and pivoting their businesses. Some 60.8% indicate they have “shifted resources to building customer-facing digital interfaces” and 56.2% are “transforming their go-to-market business models to focus on digital opportunities.” Consistent with this, CMO Survey results show the largest single drop in traditional advertising spending (-5.3% expected over the next year), further solidifying the shift toward digital.

- Marketing budgets hold: Despite headcount loss, 30.3% of marketers—the largest segment—have experienced no change in their overall marketing budgets during the pandemic with 41.3% reporting gains and 28.4% reporting losses. On average, marketers report they have gained about 5% in their budgets during the pandemic and expect an 4% increase in digital marketing spending over the next year.

- Marketing objectives remain modest: When asked what objectives they are focused on during the pandemic, the #1 and #2 responses from marketers are “building brand value that connects with customers” and “retaining current customers.” Consistent with this, marketing employees were leveraged more for “getting active online to promote the company and its offerings” (69%) and “reaching out to current customers with information” (65%) compared to growth objectives such as “generating new products and service ideas” (44%) or “building partnerships” (41%).

- Marketing leadership promoted: 62.3% of marketers report that the marketing function has increased in importance during the pandemic. Building brand and customer retention through digital, mobile, and social strategies are reported to be key to that heightened role. This importance is striking given 9% marketing job losses—marketers are doing more with fewer people.

How Covid-19 Influenced the Importance of Marketing in Companies

- Social media shines bright: 84.2% of marketers say they have used social media for brand building and 54.3% say they have used it for customer retention during the pandemic. Given this focus, marketers have increased investment social media budgets 74% since February—an increase as a percent of marketing budgets from 13.3% to 23.2%. This strategy appears to have worked: For the first time in CMO Survey history, the rated contributions of social media to company performance rose—up 24% since February. This is an important finding because social media contributions have previously remained flat and at average levels since 2016 despite rising investments.

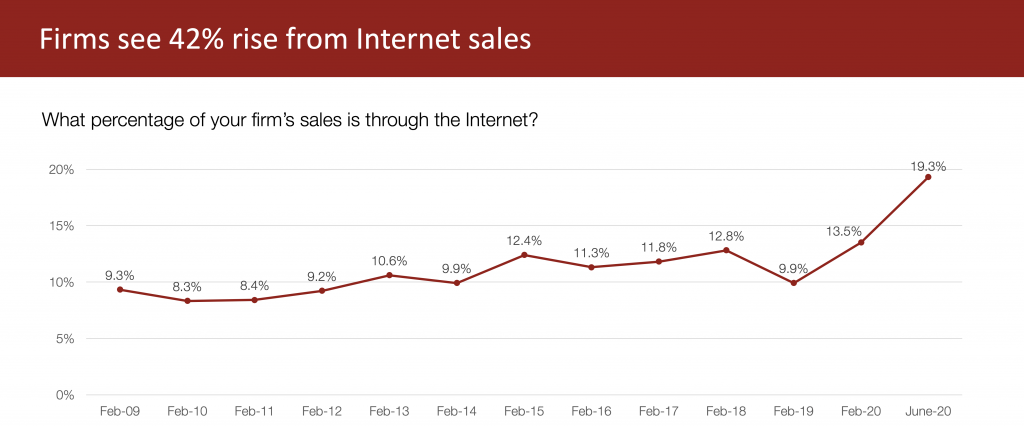

- Online sales performance increases: Online sales have grown to the highest level in The CMO Survey history. They now constitute 19.3% of sales—a 43% increase over just three months ago. Small companies (with fewer than 500 employees) are taking advantage of selling online, with ecommerce accounting for 26.1% of sales.

Percentage of Company Sales from the Internet

- Overall sales revenue drop 17%: Despite online sales gains, marketers report major losses across sales revenue, profits, and customer acquisition during the pandemic. Biggest reductions are to sales revenue, which dropped 17.8% on average, with 16.9% of marketers reporting the loss of over 50% of their revenues. Considering winners and losers, 64% of marketers report sales losses compared to 30.3% that report gains and 5.2% reporting no change. Marketers expect these sales revenues to increase 4.2% in the next year driven by the view that consumers’ current lower likelihood to purchase (67%) and unwillingness to pay full price (43%) will return to pre-pandemic levels within 6-12 months.

- Pandemic weakens environmental focus: Covid-19 has also dampened marketers’ likelihood to make changes to reduce their offerings’ negative impact on the ecological environment. The number of marketers indicating a willingness to change their products or services to reduce their negative environmental impact has dropped from 72.9% to 52.7% with attention shifting to easier-to-implement marketing promotions (58%). More marketers report that Covid-19 makes sustainability efforts seem “like a luxury” than it “created opportunities to increase sustainability efforts” in their companies.

- Use of influencers expected to rise: Marketers report that 7.5% of their marketing budgets is focused on online influencers, mostly on LinkedIn, company blogs, Instagram, and Facebook, and that they anticipate large gains in the use of influencers in the next three years (up to 12.7%).

Detailed analysis of these and other results are available at https://cmosurvey-stage.fuqua.duke.edu/results/. I hope these findings from our Special Covid-19 Edition of The CMO Survey are useful as you navigate these next few months and beyond. I will be taking a deeper dive into these findings during a webinar on June 25th at 1PM Eastern sponsored by the Marketing Science Institute and the American Marketing Association. You can register by following this link. I welcome your comments and suggestions during this event.